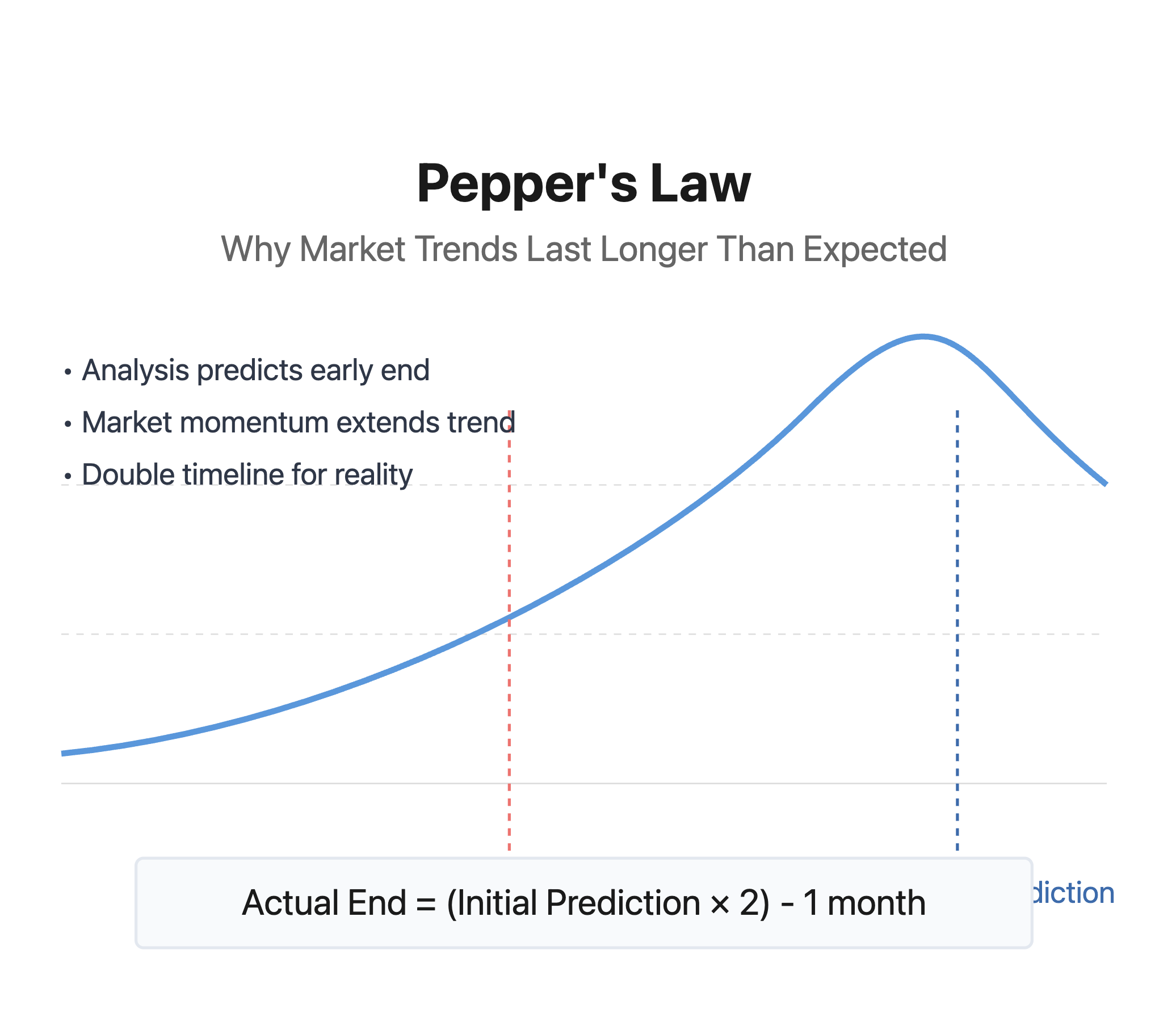

Market Trends Last Longer

Markets often defy rational analysis.

Bubbles stretch beyond logical endpoints.

Investors consistently underestimate trend durations.

Pepper's Law provides practical timing guidance.

Double your initial trend prediction.

Subtract one month for precision.

Early positioning risks premature market exits.

Market momentum defies fundamental analysis.

Current AI trends illustrate this principle.

No IPO flood suggests continued growth.

Timing market turns requires patient discipline.

Position sizing depends on extended timelines.

Risk management adapts to longer durations.

Market rationality takes unexpected paths.

Historical patterns confirm this observation.

Professional analysts often predict too early.

Emotional bias accelerates timing predictions.

Conservative estimates protect investment capital.

Market psychology drives trend persistence.

Extended trends create investment opportunities.

Success requires resisting premature actions.

Patience rewards disciplined market participants.

Understanding momentum improves investment decisions.

Market timing needs systematic approaches.

Pepper's Law guides strategic planning.